401k required minimum distribution tables

Ad Contact our experts to get started. Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year.

What Is A Required Minimum Distribution Taylor Hoffman

Do 401Ks Have Required Minimum Distribution.

. All subsequent years - by. Get Help Designing Your Plan. Use IRS Publication 590-B to calculate your 401k RMDs it includes life expectancy tables that correspond to your specific.

Traditional rollover SIMPLE and SEP. If you want to download. Optimize risk returns in your portfolio to maximize your success with a 401k strategy.

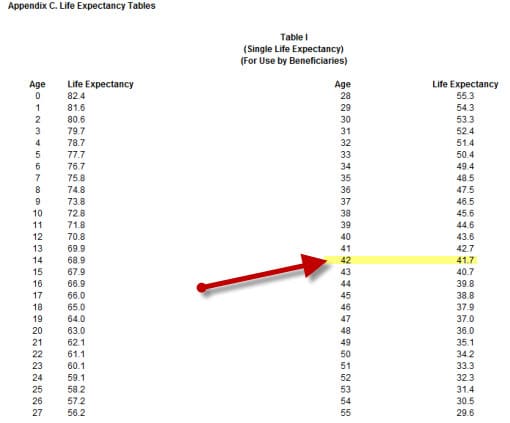

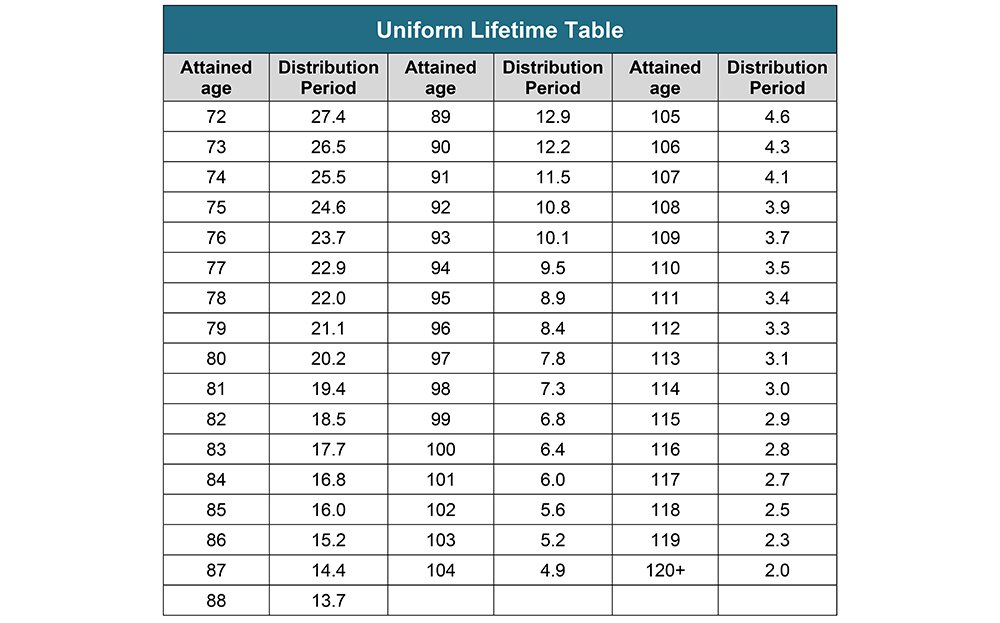

The required minimum distribution table rmd table for those who reach age 70 and the rmd table for beneficiaries are printed below. Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. Ad Discover The Benefits Of A Traditional IRA.

Invest In Clean Energy Green Bonds And Environmentally Responsible Stocks. Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Include Fossil Fuel Free Investment Options In Your Retirement Plan.

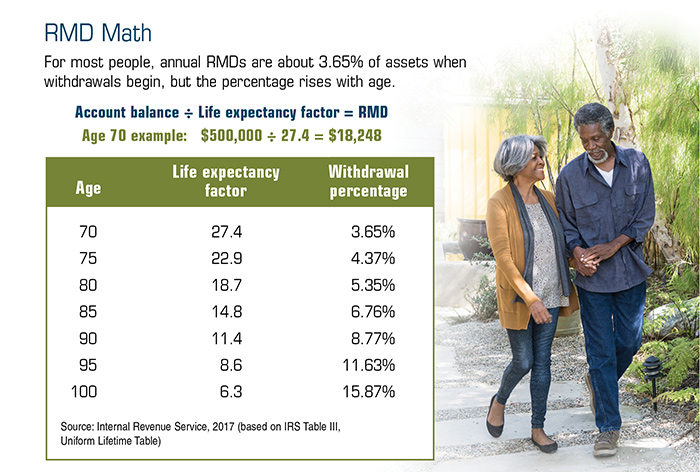

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. The RMD table shown above lists the minimum required distribution for your age. The IRS requires that you withdraw at least a minimum amount - known as.

Learn About 2021 Contribution Limits Today. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. Required minimum distributions exist to prevent retirees from never taking the money out.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. The first will still have to be taken by April 1. Required Minimum Distribution RMD Use this calculator to determine your Required Minimum Distribution RMD.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Required Minimum Distribution Calculator. Ad Discover The Benefits Of A Traditional IRA.

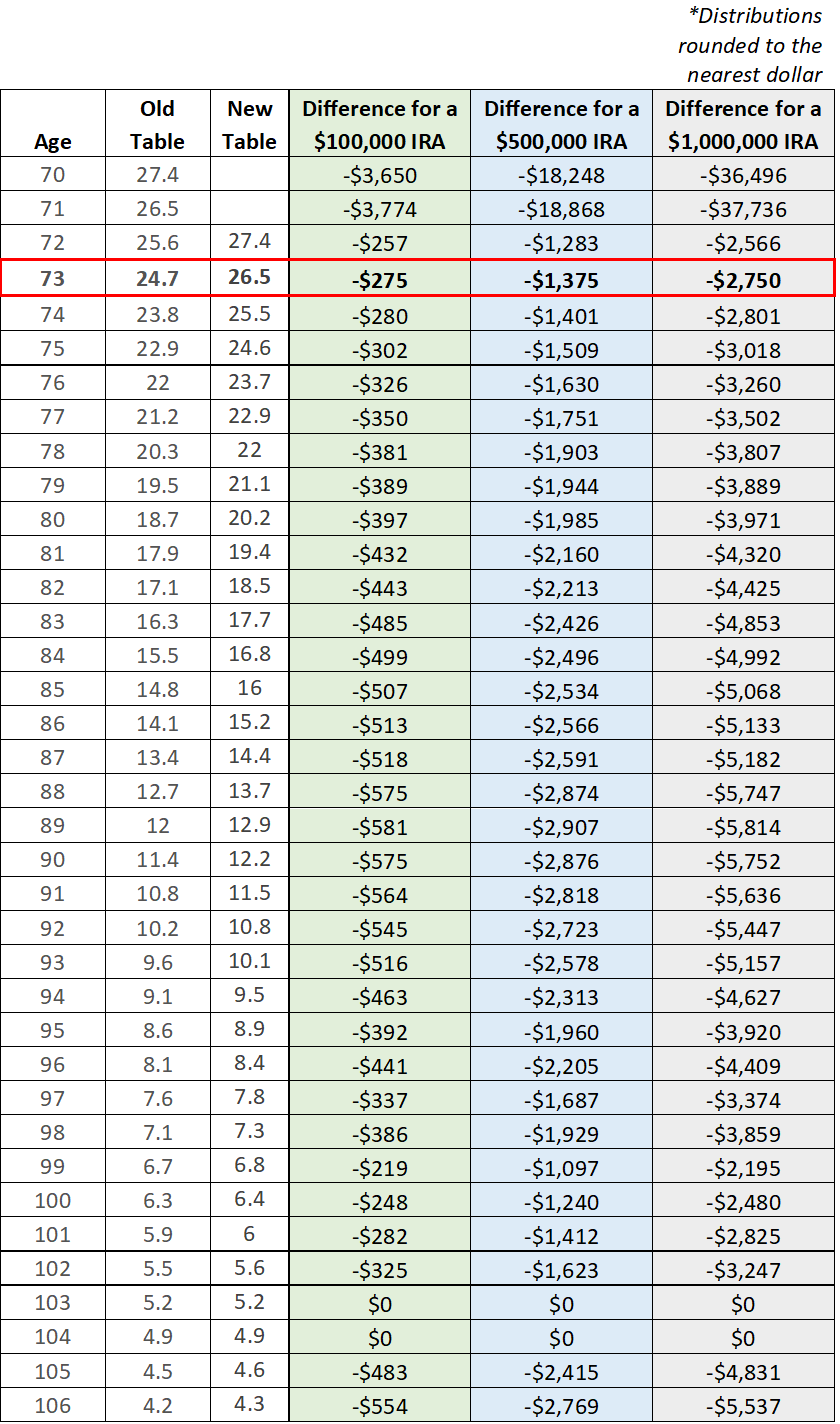

The current rules and tables have been in effect since 2002. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Deadline for receiving required minimum distribution.

A factor of 274 at age 72 means that out of a 1 million total balance in the pre-tax retirement accounts as of December 31 of the. Ad If you have a 500000 portfolio download your free copy of this guide now. Refine Your Retirement Strategy with Innovative Tools and Calculators.

The second by December 31. Ad Help Employees Get More Out of Retirement. Uniform Life Table Effective 112022.

After reaching age 72 required minimum distributions RMDs must be taken from these types of tax-deferred retirement accounts. Build Your Future With a Firm that has 85 Years of Retirement Experience. Learn About 2021 Contribution Limits Today.

The proposal to shrink required minimum distributions comes amid a blizzard of annual notices about changes to various key.

Required Minimum Distribution Rules Sensible Money

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Rmd Table Rules Requirements By Account Type

Khabar Navigating Your Required Minimum Distribution

A Guide To Required Minimum Distributions Rmds

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Rmd Tables

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Required Minimum Distribution Rules Alpha Wealth Advisors Llc

What Is A Required Minimum Distribution Tax Blog Lindstrom Accounting Stockton Ca

How Required Minimum Distributions Work Merriman

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

Back To The Basics Required Minimum Distributions Rmd Fourth Dimension Financial Group

Required Minimum Distributions Tax Diversification

Rmds Required Minimum Distributions Top Ten Questions Answered Mrb Accounting 516 427 7313

Required Minimum Distribution Calculator Estimate Minimum Amount

Your Search For The New Life Expectancy Tables Is Over Ascensus